Naira appreciated by 0.14% against the US dollar at the Investors and Exporters (I&E) window to close at N463/$1 on Wednesday, 3rd May 2023, from the closing rate of N462.33/$1 recorded in the previous trading session.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.17/$1 on 3rd May 2023, representing an appreciation of 0.13% in contrast to N463.75/$1 it recorded on Monday, 2nd May 2023.

Also, the highest rate during intra-day trading stood at N465/$1, with a forward rate of N467/$1, while the lowest rate stood at N460/$1 with a forward rate of N467/$1.

However, forex turnover increased by 13.64% to $52.32 million at the official market on Wednesday 3rd May 2023, from the $46.04 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.28 billion as of Tuesday, 2nd May 2023 from $35.25 billion recorded as of Friday, 28th April 2023.

Other indices

- The Money market overnight rate rose by 12 basis points from 11.38% recorded on Tuesday 2nd May 2023 to 11.50% on Wednesday, 3rd May 2023. The Open Repo rate stood at 11%, the same rate as recorded on Tuesday 2nd May 2023.

- DEBT: Debt securities are valued at N32.57 trillion on Wednesday 3rd May 2023, from N32.58 trillion recorded on Tuesday 2nd May 2023.

- The S&P Sovereign Bond index rose to 618.2 index points on 2nd May 2023 compared to 617.63 points recorded on Friday, 28th April 2023. This brings the month-to-date growth to 0.13%, the quarter-to-date growth to 1.05% and the year-to-date growth to 0.64%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated marginally by 0.02% to close at N462.63/$1 on Tuesday, 2nd May 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 12% for the overnight (O/N) tenor as of Tuesday 2nd May 2023. 1-month tenor (13.2%), 3-month (14.13%), while the 6-month tenor stood at 14.5%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.41%, on Tuesday 2nd May 2023.

- 3-month – 5.88%

- 6-month – 6.91%

- 9-month – 8.52%

- 12-month – 10.00%

Exchange rate drops to N462.33/$1 on 2nd May 2023 at official market

Article Summary

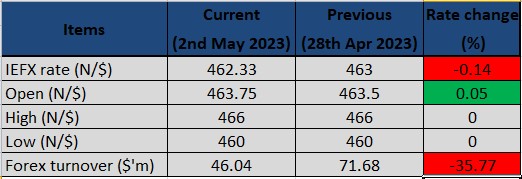

- The exchange rate between the Naira and the US dollar at the Investors and Exporters (I&E) window depreciated to close at N462.33/$1 on May 2, 2023, representing a 0.14% fall from the closing rate of N463/$1 recorded in the previous trading session.

- The sum of $46.03 million was transacted at the official market on May 2, 2023, which is 35.77% lower than the $71.68 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.25 billion as of Thursday, April 27, 2023, from $35.26 billion recorded as of Wednesday, April 26, 2023.

- The Money market overnight rate dropped by 174 basis points from 13.12% recorded on Friday, April 28, 2023, to 11.38% on Tuesday, May 2, 2023. The Open Repo rate also dropped by 162 basis points to 11% compared to 12.62% recorded on April 28, 2023.

The exchange rate between the naira and US dollar at the Investors and Exporters (I&E) window depreciated to close at N462.33/$1 on Tuesday, 2nd May 2023, representing an 0.14% fall from the closing rate of N463/$1 recorded in the previous trading session.

This is according to Nairametric’s daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.75/$1 on 2nd May 2023, a marginal appreciation of 0.05% compared to N463.50/$1 that was recorded on Friday.

Also, the highest rate during intra-day trading stood at N466 to a dollar, with a forward rate of N478.82/$1. On the flip side, the lowest rate on Wednesday stood at N460/$1 with a forward rate of N475.06/$1.

However, the sum of $46.03 million was transacted at the official market on Tuesday 2nd May 2023, which is 35.77% lower than the $71.68 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.25 billion as of Thursday, 27th April 2023 from $35.26 billion recorded as of Wednesday, 26th April 2023.

Other indices

- The Money market overnight rate dropped by 174 basis points from 13.12% recorded on Friday 28th April 2023, to 11.38% on Tuesday, 2nd May 2023. The Open Repo rate also dropped by 162 basis points to 11% compared to 12.62% recorded on 28th April 2023.

- DEBT: Debt securities is valued at N32.58 trillion on Tuesday 2nd May 2023, from N32.65 trillion recorded on 28th April 2023.

- The S&P Sovereign Bond index rose to 617.63 index points on 28th April 2023 compared to 616.12 points recorded on Thursday, 27th April 2023. This brings the month-to-date growth to 0.04%, the quarter-to-date growth to 0.96% and the year-to-date growth to 0.54%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated marginally by 0.03% to close at N462.70/$1 on Friday, 28th April 2023.

- NIBOR: The Nigerian Inter-Bank Offered rate stood at 11.55% for the overnight (O/N) tenor as of 28th April 2023. 1-month tenor (11.84%), 3-month (12.51%), while the 6-month tenor stood at 13.34%.

- NITTY: The Nigerian Inter-Bank Treasury Bills True Yields’ 1-month tenor rate stood at 4.34%, on Friday, 28th April 2023.

- 3-month – 5.76%

- 6-month – 6.72%

- 9-month – 8.84%

- 12-month – 10.15%

Official exchange rate fell to N462/$1 on 27th April 2023

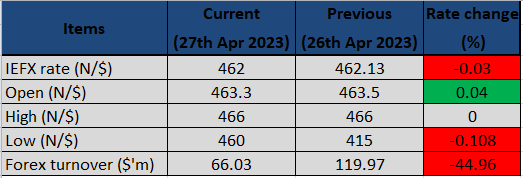

The exchange rate between the naira and US dollar at the Investors and Exporters (I&E) window traded to close at N462/$1 on Thursday, 27th April 2023. This represents a marginal depreciation of 0.03% compared to the closing rate of N462.13/$1 recorded in the previous trading session.

This is according to Nairametrics daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.30/$1 on 27th April 2023, in contrast to N463.50/$1 that was recorded on Wednesday.

Also, the highest rate during intra-day trading stood at N466 to a dollar, with a forward rate of N478.57/$1, while the rate settled at N462/$1. On the flip side, the lowest rate on Wednesday stood at N460/$1 with a forward rate of N477.77/$1.

However, Forex supply decreased by 44.96% to $66.03 million at the official market on Thursday, 27th April 2023, from $119.97 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.29 billion as of Tuesday, 25th April 2023 from $35.31 billion recorded as of the beginning of the week.

Other indices

- The Money market overnight rate dropped by 25 basis points from 11.50% recorded on Wednesday 26th April 2023, to 11.25% on Thursday, 27th April 2023. The Open Repo rate also dropped to 11% in contrast to the 11.12% recorded on 26th April 2023.

- The S&P Sovereign Bond index rose to 615.97 index points on 26th April 2023 compared to 613.18 points recorded on Tuesday, 25th April 2023. This brings the month-to-date growth to 0.46%, while the year-to-date growth to 0.27%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate depreciated by 0.13% to close at N461.92/$1 on Wednesday, 26th April 2023.

- NIBOR: The Nigerian Inter-bank Offered rate stood at 13.21% for the overnight (O/N) tenor as of 26th April 2023. 1-month tenor (12.22%), 3-month (12.84%), while the 6-month tenor stood at 13.386%.

- NITTY: The Nigerian Inter-bank Treasury Bills True Yields’ 1-month tenor rate stood at 5.82%, on Thursday, 20th April 2023.

- 3-month – 7.06%

- 6-month – 9.05%

- 9-month – 11.61%

- 12-month – 13.78%

Official exchange rate strengthens to N462.13/$1 on April 26th

The exchange rate between the naira and US dollar at the Investors and Exporters (I&E) window closed at N462.13/$1 on Wednesday, 26th April 2023. This represents a 0.28% gain compared to the closing rate of N463.44/$1 recorded in the previous trading session.

This is according to Nairametrics’ daily currency update, tracked and compiled from FMDQ Exchange.

The exchange rate at the IEFX recorded an opening indicative rate of N463.50 to a dollar on 26th April 2023, in contrast to N463.10/$1 that was recorded on Tuesday.

Also, the highest rate during intra-day trading stood at N466/$1, with a forward rate of N477.99/$1, while the rate settled at N462.13/$1. On the flip side, the lowest rate on Wednesday stood at N415/$1 with a forward rate of N462/$1.

In terms of forex turnover, a total of $119.97 million was traded at the official market, which is 91.37% higher than the $62.69 million that exchanged hands in the previous session. Meanwhile, the nation’s external reserves stood at $35.29 billion as of Tuesday, 25th April 2023 from $35.31 billion recorded as of the beginning of the week.

Other indices

- The Money market overnight rate dropped by 375 basis points from 15.25% recorded on Tuesday 25th April 2023, to 11.50% on Wednesday, 26th April 2023. The Open Repo rate also dropped to 11.12% in contrast to the 14.62% recorded on 25th April 2023.

- The S&P Sovereign Bond index rose to 613.18 index points on 25th April 2023 compared to 612.74 points recorded last week Thursday. This brings the month-to-date growth to 0.23%, while the year-to-date growth stood at -0.18%.

- NAFEX: The Nigerian Autonomous Foreign Exchange Fixing rate appreciated by 0.06% to close at N462.43/$1 on Thursday, 20th April 2023.

- NIBOR: The Nigerian Inter-bank Offered rate stood at 18.75% for the overnight (O/N) tenor as of 20th April 2023. 1-month tenor (15.75%), 3-month (16.53%), while the 6-month tenor stood at 16.69%.

- NITTY: The Nigerian Inter-bank Treasury Bills True Yields’ 1-month tenor rate stood at 5.82%, on Thursday, 20th April 2023.

- 3-month – 7.06%

- 6-month – 9.05%

- 9-month – 11.61%

- 12-month – 13.78%