Key highlights

- The reporting season for PFA’s has begun.

- On 28 March Premium Pension Limited published summary accounts for the company and the pension funds it manages.

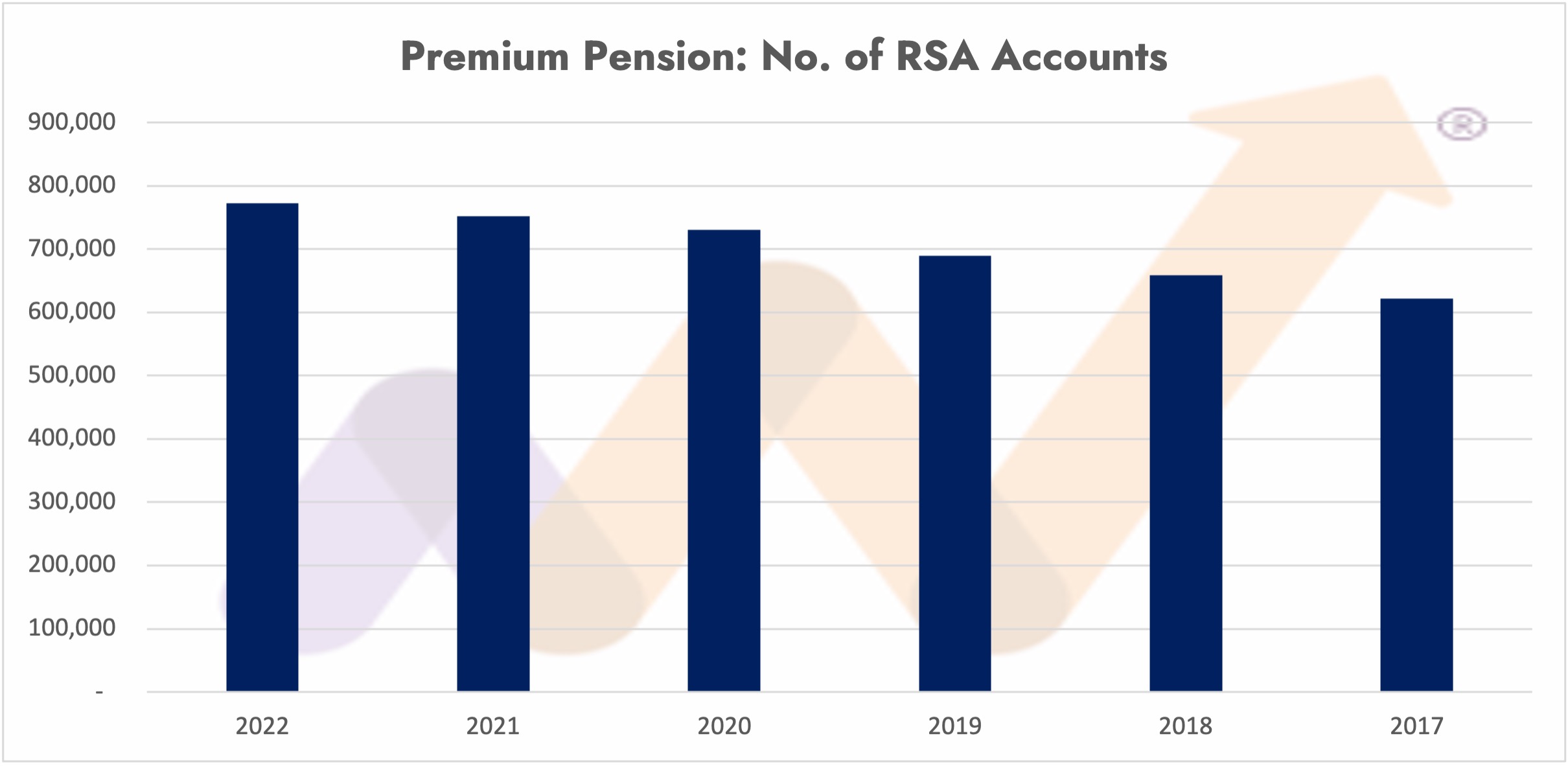

- The company closed the year with 772,885 RSA holders and total RSA assets under management of N860.43bn.

Some observations

Whilst the company complies with PenCom regulations and publishes corporate and fund accounts in the national dailies, it only uploads corporate accounts unto its website, which is puzzling as to why. Despite enquiries to the company in the last 3 years that action has not changed. It is also worth noting that not one single PFA releases the FULL (not summary as all do) set of audited accounts, even when a direct enquiry is made to obtain such, which is also puzzling. Also, there are currently no benchmarks to compare the performance of pension fund returns to other than between one PFA and the others and existing metrices like inflation, the NGX All-share index, interest rates, bond yields and treasury bill rates.

Company accounts

Premium Pension Limited was incorporated in March 2005 and was licensed by PenCom as a Pension Fund Administrator (PFA) in November 2005. Total income for the year ended 31 December 2022 grew 18.34% to N10.04bn from N8.48bn the year before. Having climbed over the previous 4 years, the company’s cost to income ratio went down to 60.27% from 64.65% the year before. This ratio has now averaged 60.65% over the last 5 years. Profit After Tax grew 35.51% to N2.65bn. This stemmed the falling tide as PAT had been falling over the prior 3 years. This growth in PAT boosted the companies Return on Equity which closed the year at 37.33% stemming the declines which started in 2018 when the company had an ROE of 62.94%. Shareholders funds grew 10.64% to N7.11bn from N6.43bn in 2021.

Fund accounts:

Premium Pension offers all 7 PenCom approved funds to the public.

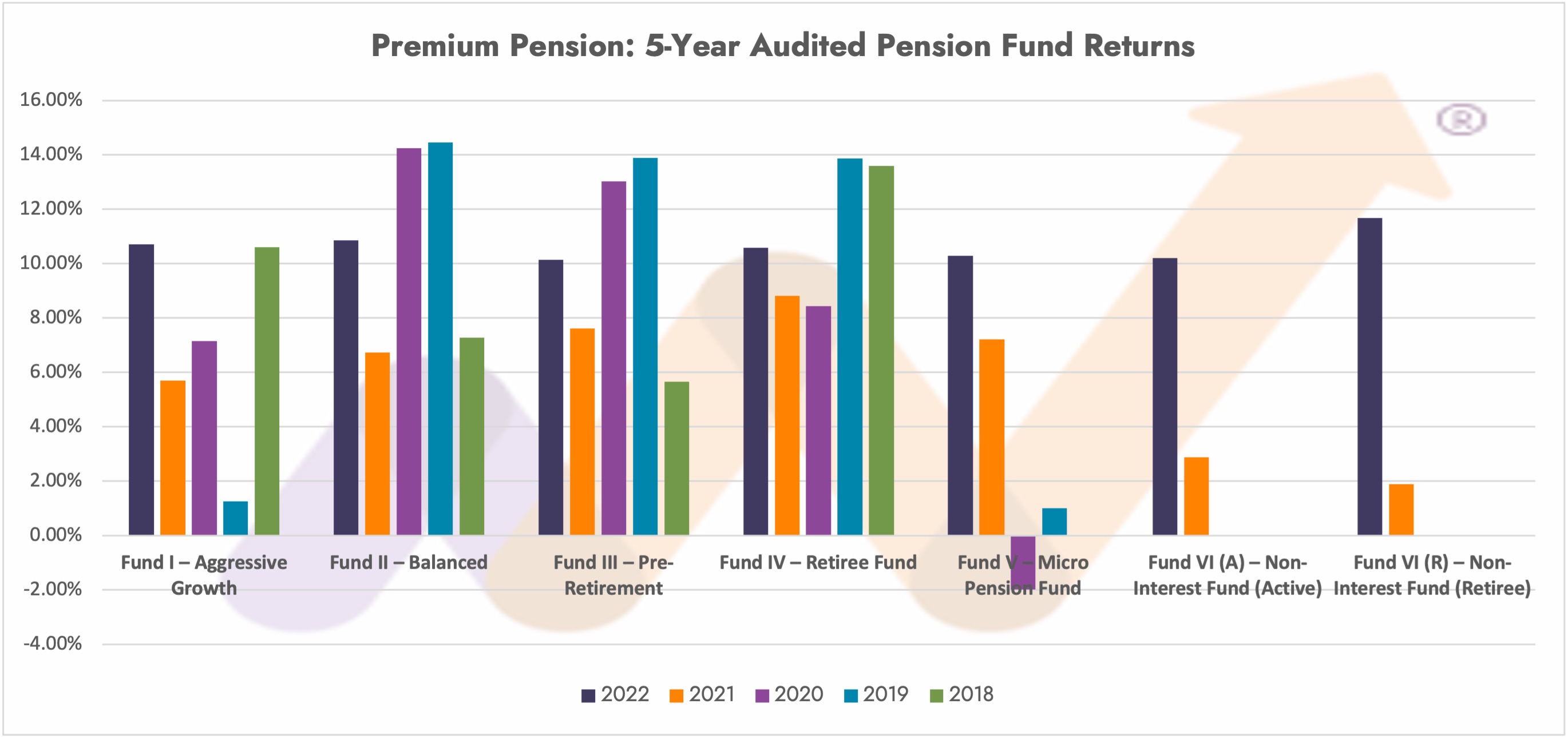

Premium Pension Fund I

Income earned in the Premium Pension Fund I grew triple digits, 211% to N60.84mn from N19.56mn in 2021, with net gains from investing activities rising to N49.73mn from N14.46mn. The funds expense ratio (this is the figure that captures the annual cost of managing the fund), rose to 1.80% from 1.37%. Over the last 5 years the ratio has averaged 1.70%. The fund managers generated a return of 10.71% in 2022 compared to 5.70% in 2021. The fund underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 11 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund II

Income earned in the Premium Pension Fund II grew 65.17% to N44.01bn from N26.64bn in 2021, with net gains from investing activities rising to N37.57bn from N21.06bn. The funds expense ratio rose slightly to 1.68% from 1.63%. Over the last 5 years the ratio has averaged 1.95%, hence some improvements taking place. The fund managers generated a return of 10.87% in 2022 compared to 6.73% in 2021. The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 10 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund III

Income earned in the Premium Pension Fund III grew 38.24% to N38.68bn from N27.98bn in 2021, with net gains from investing activities rising to N33.18bn from N23.12bn. The funds expense ratio rose marginally to 1.53% from 1.52%. 5-year average has been 1.42%. The fund managers generated a return of 10.13% in 2022 compared to 7.62% in 2021. The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 13 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund IV

Income earned in the Premium Pension Fund IV grew 35.40% to N11.42bn from N8.44bn in 2021, with net gains from investing activities rising to N10.50bn from N7.74bn. The funds expense ratio was 0.83% compared to 0.71% in 2021. The 5-year average has been 0.84%. The fund managers generated a return of 10.59% in 2022 compared to 8.82% in 2021. The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 7 out of 19 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund V

Income earned in the Premium Pension Fund V grew 194.82% to N1.71mn from N0.58mn in 2021, with net gains from investing activities rising to N1.47mn from N0.39mn. The funds expense ratio fell to 1.21% compared to 1.61% in 2021. The fund managers generated a return of 10.29% in 2022 compared to 7.22% in 2021. The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 9 out of 14 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund VI (Active)

Income earned in the Premium Pension Fund VI (Active) grew to N386.07mn from N36.91mn in 2021, with net gains from investing activities rising to N327.59mn from N30.75mn. The funds expense ratio had a big leap to 1.37% from 0.33%. The fund managers generated a return of 10.22% in 2022 compared to 2.88% in 2021 (2021 was a partial year). The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 4 out of 11 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Premium Pension Fund VI (Retiree)

Income earned in the Premium Pension Fund VI (Retiree) grew to N84.43mn from N3.5mn in 2021, with net gains from investing activities rising to N77.46mn from N3.02mn. The funds expense ratio was 0.81%, up from 0.25%. The fund managers generated a return of 11.67% in 2022 compared to 1.89% in 2021 (2021 was also a partial year). The fund also underperformed the stock market (19.98%), it’s returns were lower than inflation (21.47%) and even lower than MPR (16.50%). In 2021 the fund ranked 2nd out of 5 in terms of performance. The ranking for 2022 will be revealed in our 2023 report later in the year.

Overall, it’s too early to form an opinion as to the overall performance trend of these funds and in comparison, to its peers, but generally the company custodians are generating better returns for the company’s shareholders with a 2022 ROE of 37.33%.

Coming soon our 2023 Annual Report on ALL PFA’s. See our 2022 report here:

the Money Counsellors Annual Report on Pensions (MCARP 2022) for a full analysis of all Pension Fund Administrators (PFA) in one single document. The report presents a holistic review of the last five years of activities of all PFAs, and the funds managed, including 5-year summary company and fund accounts, ratios, fund performances, fund performance rankings vs. peers, asset allocation, AUM ranking, RSA ranking and much more.

Our data and information provided is based on public data, our regulatory intelligence effort, from our archives, and other public sources such as from Fund Managers, FMAN, Pension Fund Administrators (PFAs), PenOp, etc. We have taken care to ensure that the information is correct, but MoneyCounsellors neither warrants, represents, nor guarantees the information’s contents, nor does it accept responsibility for any errors, inaccuracies, omissions, or inconsistencies contained herein. Because past performance does not predict future performance, it should not be used to make an investment decision. We make no product recommendations. No news or research item on our website or in this document should be interpreted as a personal recommendation to buy, sell, or switch any investment. Investments and the income generated by them rise and fall in value, so you may receive more or less than you invested.