Nigerian mutual funds are attempting to attain the peak of Assets Under Management (AUM) which was last attained in February 2021.

At the end of December 2020 AUM was N1.572 trillion, rose to N1.583 trillion in February 2021 but at the close of 2021 had fallen by 11.26% to N1.405 trillion. In 2022 AUM grew by 8.06% and with data released by SEC for the end of January 2023, AUM has grown 3.92% so far this year, pushing figures up to N1.578 trillion, just 0.35% short of the peak of 2021.

From 2011 to the end of 2022, mutual funds AUM has grown by a 1,958%, a CAGR of 31.64% (by comparison, though much larger, Nigerian pension funds aum has grown by 512%, a CAGR of 17.90% over the same period).

The no. of products continues to progressively grow, leaping from 116 in 2020 to 147 products as of the end of January 2023. Compared to 33 in 2020, there are now 40 mutual fund asset managers offering mutual funds and whilst total AUM continues to grow, only Shari’ah compliant funds have scaled a previous peak in AUM with others still playing catch-up. To see a more detailed breakdown per fund types visit https://moneycounsellors.com/industry_trends#subtab-26.

Do you know what to look for in an asset manager managing mutual funds? Find out more in the Money Counsellors Guide ‘What to look for when evaluating a mutual fund manager’. The guide is free and available to download here or scan the QR code.

Performance of mutual funds for January 2023

Note: We have reported price returns as reported and not considered fund managers different valuation policies nor distributions as the information is unavailable.

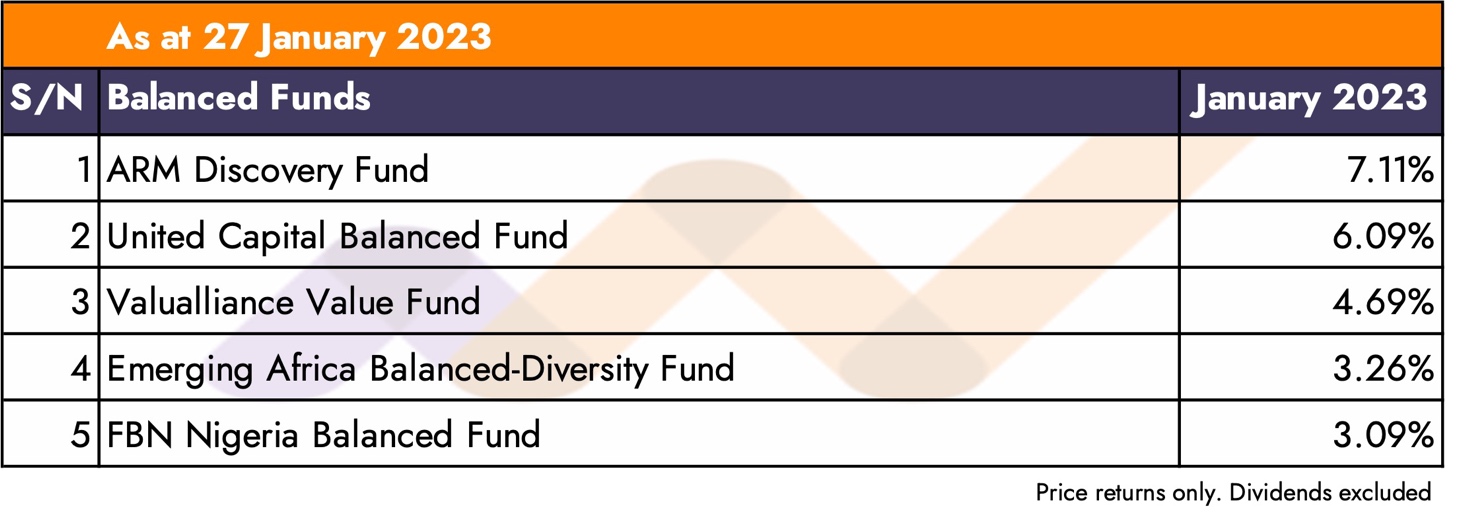

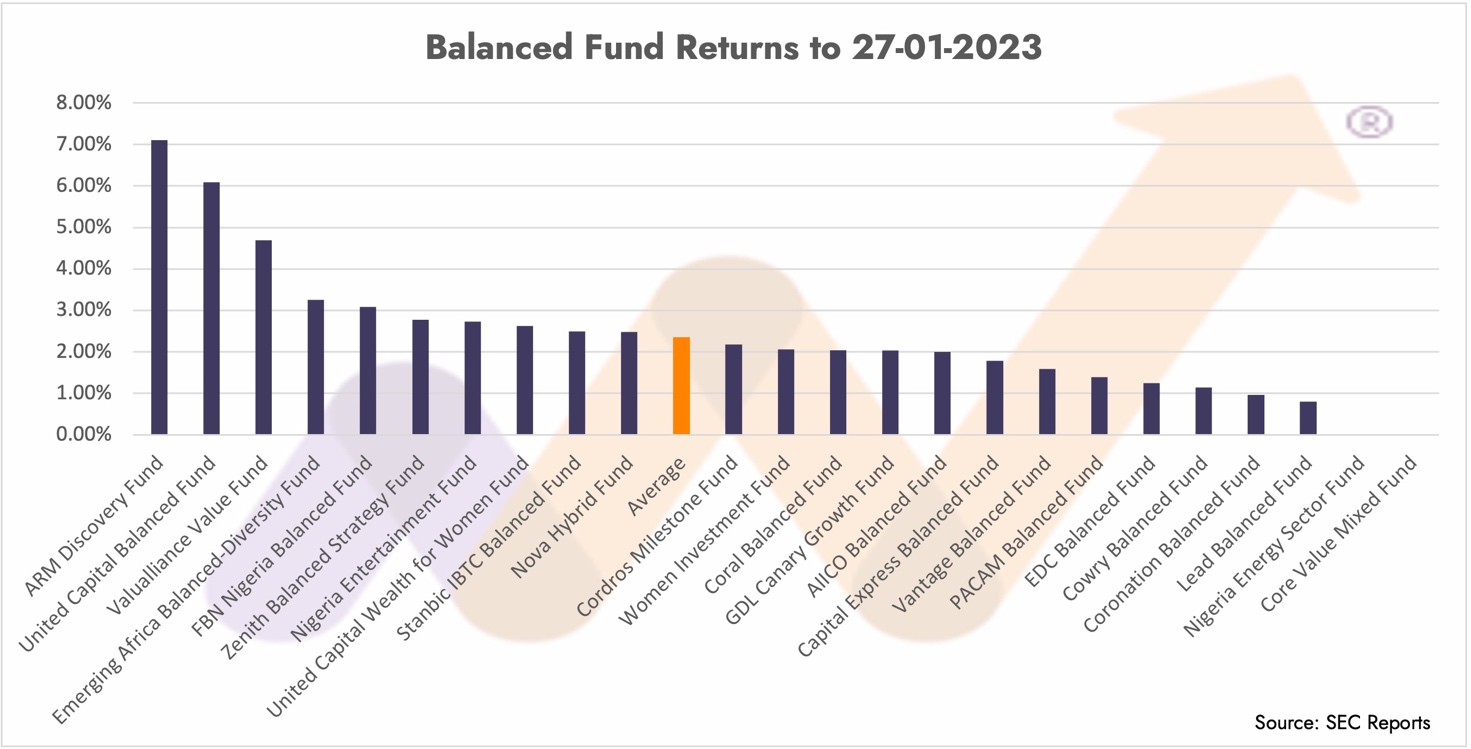

Balanced Funds

If you do not want to take too much risk, balanced funds, also known as mixed funds, might be your answer. Balanced funds are mutual funds that invest in a mix of investment instruments that range from money market instruments, bonds, equities and at times real estate and other assets. The proportion and mix of such assets in a portfolio will vary with income and gains/losses coming from each asset class.

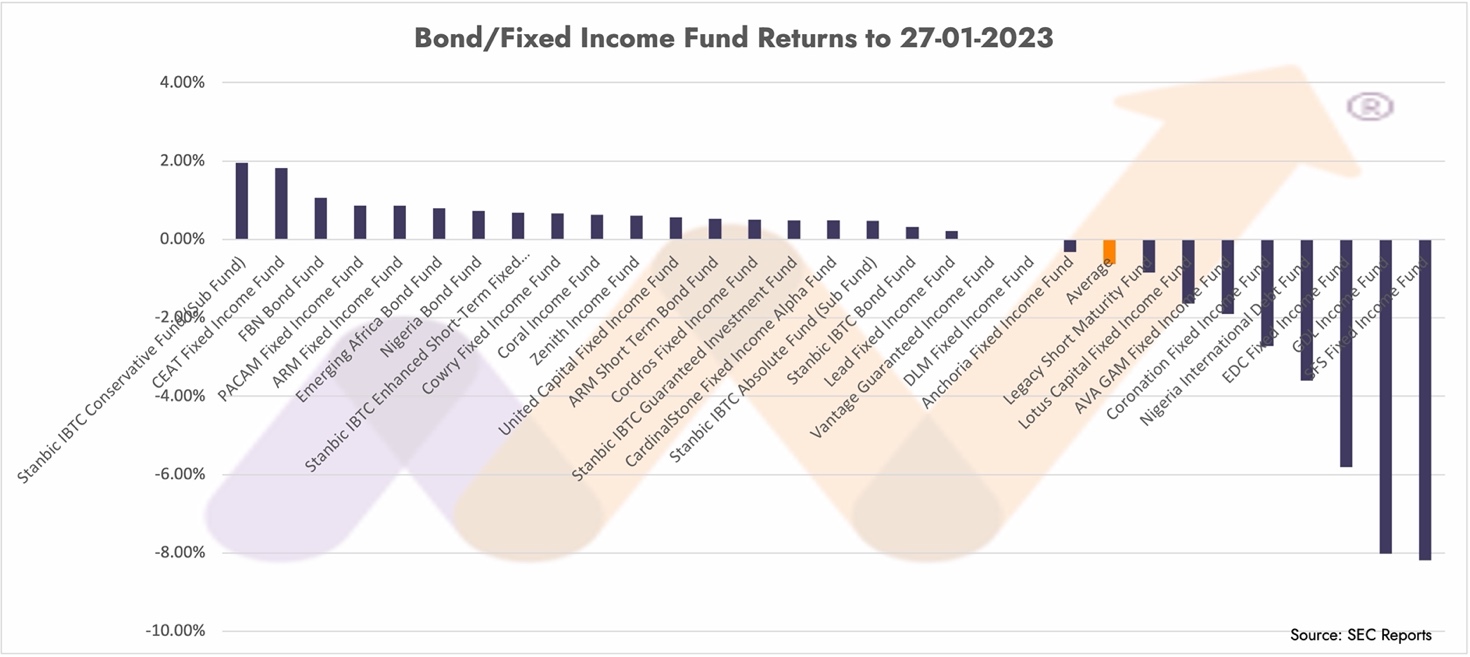

Bond/Fixed Income Funds

If you are uncomfortable with having equities in an investment portfolio and prefer a regular source of and/or fixed income, bond/fixed income funds may be just for you. Bond/Fixed Income funds are mutual funds that invest in a portfolio of debt instruments issued by governments, companies, and other entities. Examples of such instruments include FGN Bonds, State government bonds, Eurobonds, Corporate bonds and may include such others like Commercial papers and Treasury Bills. Some of the instruments may pay a fixed level of cash flows at pre-scheduled intervals over time. The funds will likely make periodic dividend payments from interest earned and sometimes capital appreciation earned from the funds underlying instruments.

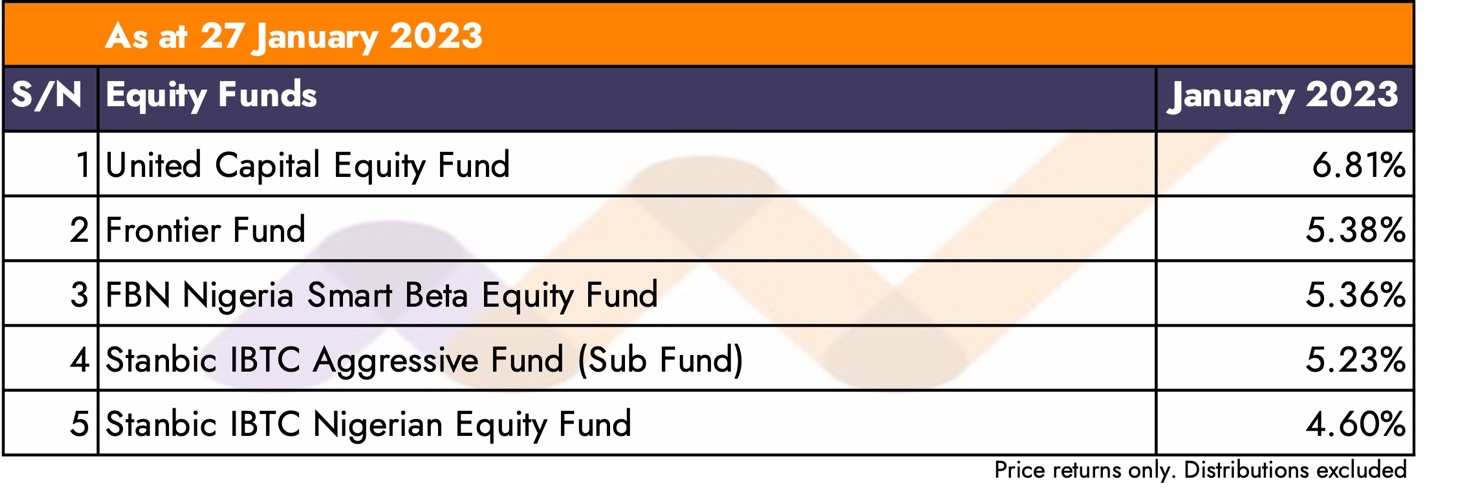

Equity Funds

If you have a long investment horizon and can cope with the up and down gyrations of an equity market, then equity funds may just be for you. In the real sense, these funds should invest 100% of their funds in the equity market. However, equity funds in Nigeria leave the back door open for them to be able to invest in fixed income instruments. Equity funds are mutual funds that invest primarily and mostly in shares.

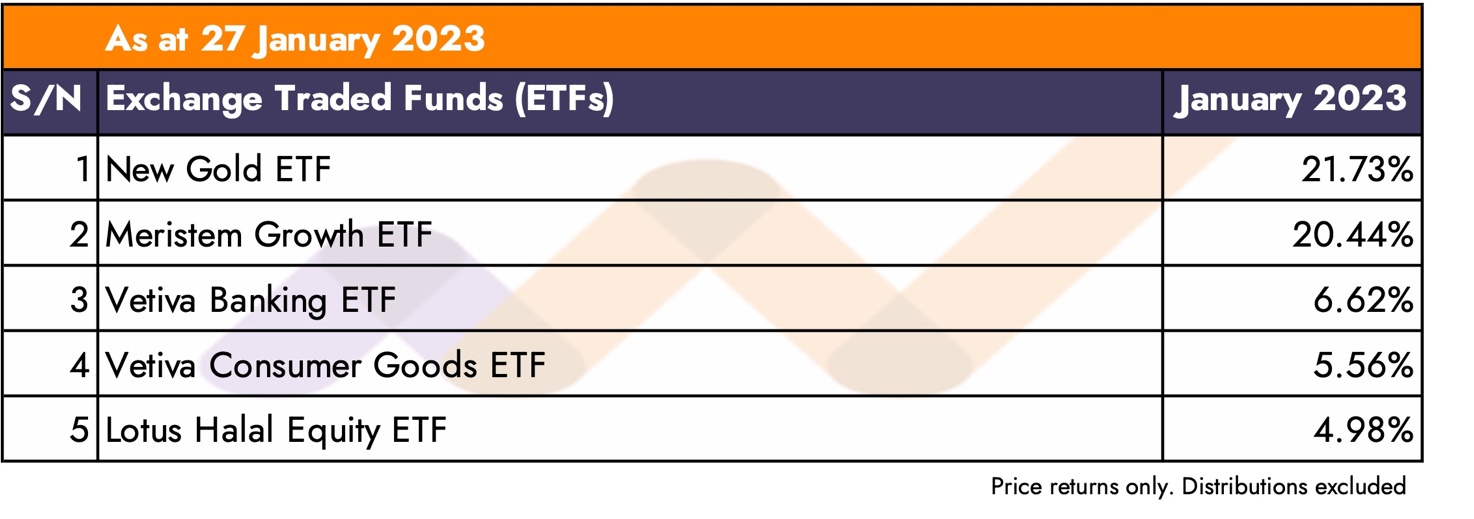

ETF’s

A low-cost way of getting exposure to the market is via an Exchange Traded Fund. An Exchange Traded Fund, popularly known as ETF is a security that is listed and traded throughout the day on the stock exchange. This security is made up of a portfolio of securities in the fund that tracks an underlying index.

Ethical Funds

Ethical funds are mutual funds where investment decisions are made after taking into consideration some agreed ethical factors. Such factors can be set from a religious, environmental, social, governance or other moral perspective.

Infrastructure Funds

An Infrastructure fund will provide you opportunities to invest in infrastructure which could range from toll roads, airports, and rail facilities to power, telecoms and other utilities but is not limited to such.

Money Market Funds

Money market mutual funds are low risk funds that invest in money market instruments such as treasury bills, commercial papers, bank deposits, etc. With current regulations, no instrument in the fund should have a maturity of more than 364 days, and an average maturity of no more than 90 days. Money Market Funds are required to maintain a stable NAV, i.e., the price should not fall below the issue price. All income is distributed out to investors, though an investor may choose to reinvest their income.

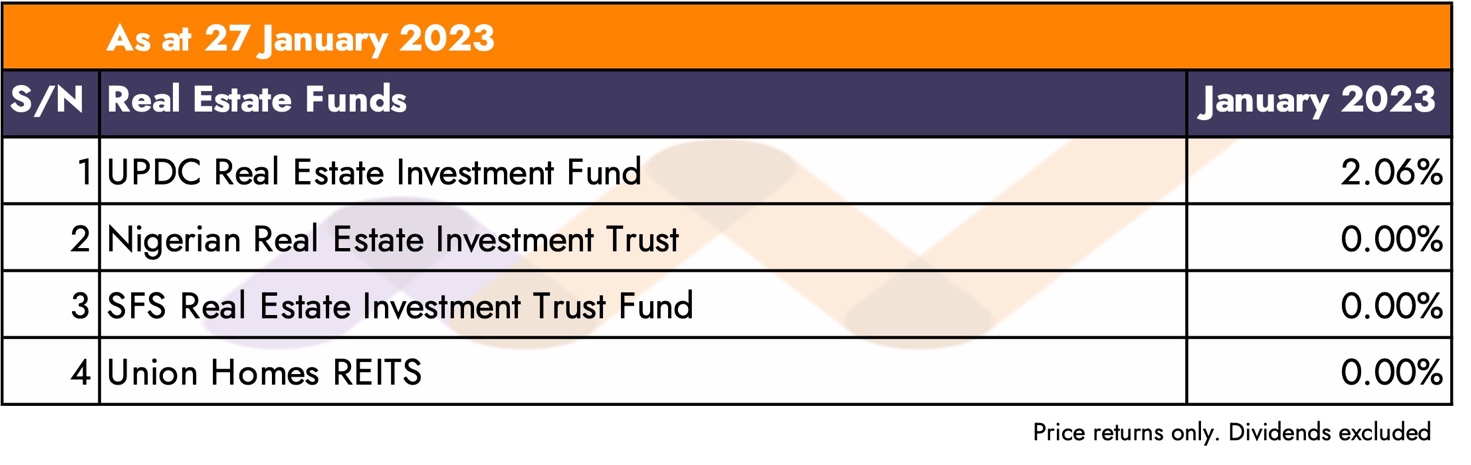

Real Estate Funds

Real Estate investment funds, also known as Real Estate Investment Trusts (REITs) are funds that owns, operates, and maintains income producing properties (real estate). They generate a steady stream of income for investors and may offer some capital appreciation too.

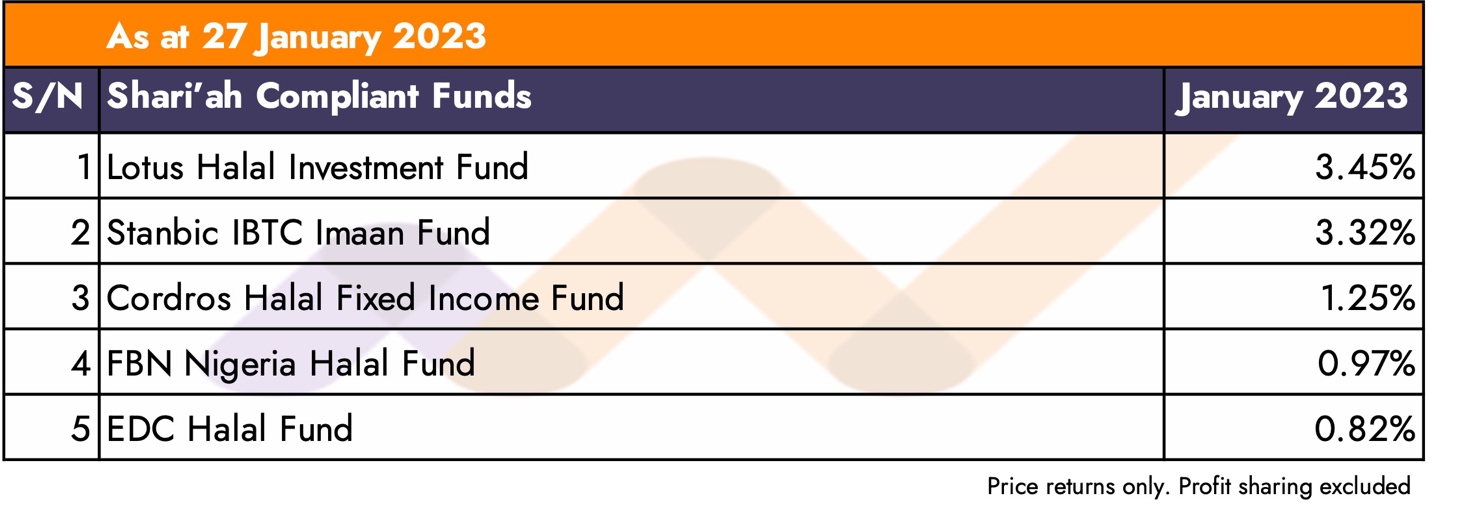

Shari’ah Compliant Funds

Shari’ah compliant funds are mutual funds setup to comply with Islamic law. These funds allow investors to invest their money in instruments and companies that engage in behaviour according to Shari’ah law.

USD Funds

USD funds, are funds that invest in US$ denominated instruments, e.g., Eurobonds, US$ bank deposits, etc.

Click on each respective class of fund grouping to access and view all the funds and their managers

Do you have a pension or thinking of opening a Retirement Savings Account for your pension with a PFA? Click here to read our December 2022 report on the performance of pension funds for 2022.

You can also review the 5-year performance of each PFA and the funds they manage by clicking here to download the Money Counsellors Annual Report on Pensions.

Our data and information provided is based on public data, our regulatory intelligence effort, from our archives, and other public sources such as from Fund Managers, FMAN, Pension Fund Administrators (PFAs), PenOp, etc. We have taken care to ensure that the information is correct, but MoneyCounsellors neither warrants, represents, nor guarantees the information’s contents, nor does it accept responsibility for any errors, inaccuracies, omissions, or inconsistencies contained herein. Because past performance does not predict future performance, it should not be used to make an investment decision. We make no product recommendations. No news or research item on our website or in this document should be interpreted as a personal recommendation to buy, sell, or switch any investment. Investments and the income generated by them rise and fall in value, so you may receive more or less than you invested.

© MoneyCounsellors.com